Families across the country are stressed out when it comes to their personal finances

By offering robust financial wellness programs, companies can help manage this stress.

40%

of U.S. adults have less than $1,000 saved to deal with unexpected expenses.

58%

of employees admit they’re stressed about finances; and 50% of those say finances have been a distraction at work.

45 million borrowers

Americans owe student loans worth more than $1.4 trillion* according to The White House.

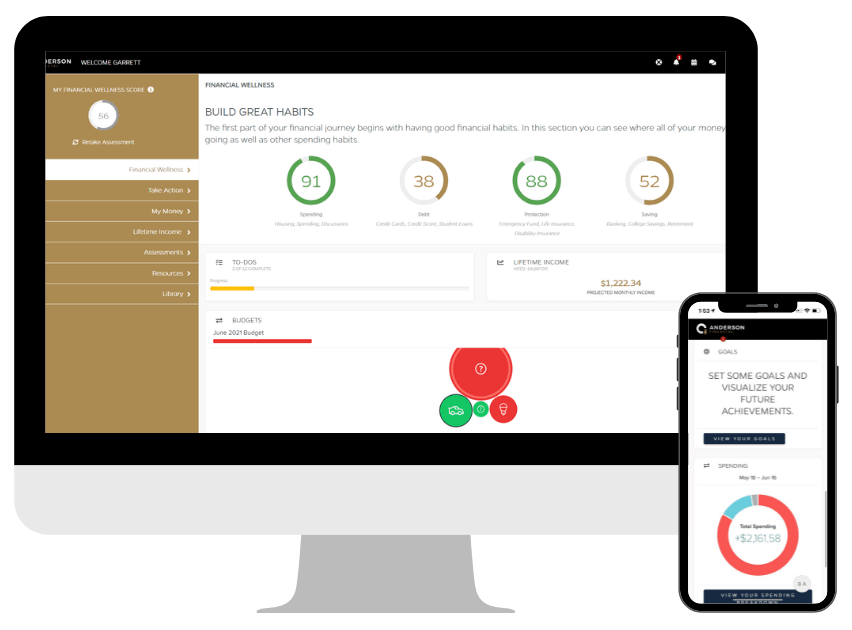

Empower Your Workforce

Financial Wellness programs strive to improve the health of a retirement plan by increasing deferral rates, reducing loans and improving the way employees plan and invest for retirement. However, software alone doesn’t power behavior change. The key missing ingredient is the human element. Our advisors aim to solve this problem.