Empower Your Workforce

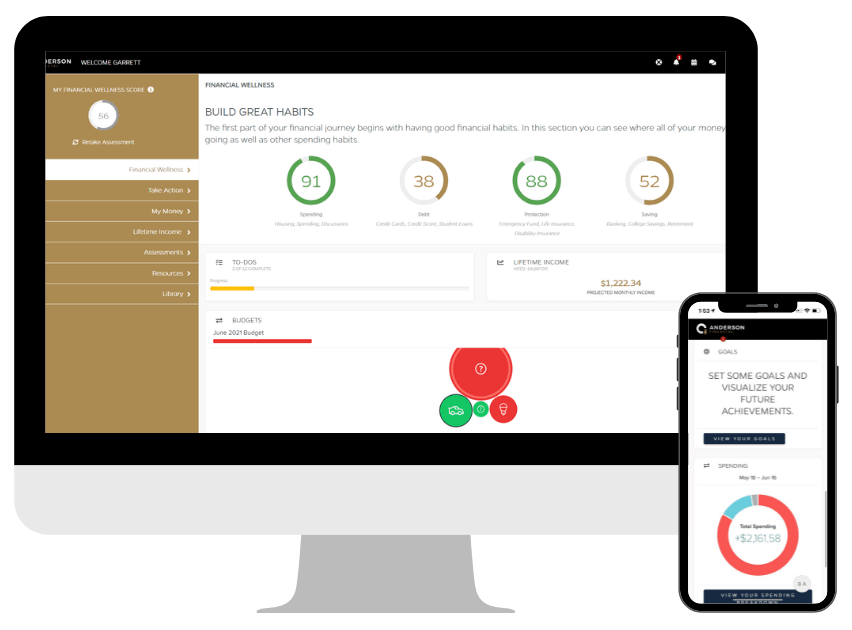

Financial Wellness programs strive to improve the health of a retirement plan by increasing deferral rates, reducing loans and improving the way employees plan and invest for retirement. However, software alone doesn’t power behavior change. The key missing ingredient is the human element. Our advisors aim to solve this problem.

3(21) and 3(38) Fiduciary Advice

What does that mean!? It’s simple — we are personally liable if we give you advice not in your best interest.

Transparent Fees

No hidden fees! Our transparent fee schedule makes it easy to understand exactly how we get paid.

Goals + outcome Focused

Our goals based philosophy impacts both our retirement plan consulting and financial planning.

Virtual Financial Advisors

COVID19 has created many challenges, meeting with us is not one.